Facebook marketing for insurance agents: 15 examples, strategy & an AI-powered launch

Struggling to make Facebook marketing for insurance actually bring you qualified leads? See Zeely AI’s top examples and ideas that guide you toward winning insurance campaigns.

If you’re a small brokerage or an independent agent, you don’t need a big agency budget to get results. What you need is a clear Facebook marketing plan that reduces wasted spend, improves lead quality, and helps you compete with larger players. And thanks to AI ad creation tools, you can now launch campaigns in minutes, not weeks.

This guide will walk you through:

- What Facebook marketing means for insurance professionals

- The exact steps to set up your strategy

- Hidden pitfalls and proven pro tips from other agents

- How to kick off your first campaign using Zeely, an AI ad generator that simplifies everything

Let’s break it down in a way that’s simple, actionable, and designed to help you win.

What is Facebook marketing for insurance agents?

When you think about Facebook, you probably picture people scrolling through updates, photos, or community news. But for you as an insurance agent, Facebook is also one of the most powerful business tools you can use. Facebook marketing for insurance agents means running a mix of paid ads, organic posts, and lead campaigns designed to connect with people right at the moment they’re thinking about protection, savings, or big life changes.

At its core, this type of marketing follows a simple funnel: you create helpful or eye-catching content, capture interest through Facebook lead ads for insurance, and then move those leads into a call, Messenger chat, or landing page. From there, you turn conversations into quotes and quotes into policies.

Benefits of Facebook for insurance professionals

- Massive audience reach: Facebook remains one of the top platforms among adults. According to Pew Research, “YouTube and Facebook are by far the most used online platforms among U.S. adults.” That means your prospects are already active where you can reach them.

Cost efficiency: Compared to direct mail or cold calling, Facebook ads often deliver a lower cost per lead. WordStream found that “…click-through rate and conversion rate both increased this year, while cost per click and cost per lead went down.” This matters because it allows you to test offers without breaking your budget. - Laser targeting: You can build audiences by zip code, income bracket, or life events like moving to a new home or turning 65. This is what makes insurance Facebook ads so effective, you reach people right when they’re most likely to buy.

- Quick feedback loop: Unlike traditional campaigns, you can see within days which ads are resonating and adjust your budget accordingly.

15 examples of Facebook ads for insurance agents in 2026

Carousel savings ad — “See how much your neighbors saved”

A multi-card carousel ad shows before-and-after premiums for local drivers.

Why it works:

- Taps into local proof and relatability

- Uses tangible savings numbers

- Matches cost-conscious buyer intent

- Builds trust with real data

How to use it: Show 3–5 cards with customer stories, each ending in “Get your quote today.” Use city names to anchor local trust.

Click-to-call auto ad — “Talk to an agent now”

An image ad with a tap-to-call button connects mobile users instantly.

Why it works:

- Speaks to urgency

- Reduces friction for mobile-first buyers

- Appeals to those who prefer voice over forms

- Converts impulse interest into conversations

How to use it: Write copy like “Need lower auto insurance today?” Add a phone CTA and route calls to a dedicated sales line for fast response.

Explainer video ad — “3 steps to lower your premium”

A short video breaks down the process of saving on auto insurance.

Why it works:

- Educational, builds authority

- Snackable for Facebook scrolling

- Improves engagement over static images

- Increases retention of your message

How to use it: Script a 30-second clip with simple graphics and subtitles. Show the journey from quote to savings, then close with “Get your rate.”

Family protection video — “Secure their future today”

A heart-touching video highlights a family’s relief after getting life insurance.

Why it works:

- Emotional resonance with parents

- Reinforces family-first values

- Matches long-term security intent

- Creates urgency with personal stakes

How to use it: Film or animate a scenario where insurance saved a family from hardship. End with CTA: “Protect your loved ones—get your free quote.”

Infographic cost ad — “Average funeral costs in 2026”

An image chart shows the rising cost of funerals vs. the price of coverage.

Why it works:

- Visualizes pain point

- Appeals to cost-avoidance motivation

- Factual proof increases credibility

- Matches informational intent

How to use it: Create a simple graphic comparing expenses. Caption: “Don’t leave your family with unexpected bills. Secure affordable life insurance today.”

Messenger ad — “Chat with a local agent now”

An ad opens a Messenger thread with your agency for instant Q&A.

Why it works:

- Removes sign-up barrier

- Fits conversational buyer journey

- Builds trust with real-time response

- Boosts conversion from casual interest

How to use it: Use headlines like “Want to know life insurance costs in [City]?” Encourage chat. Assign staff to answer quickly and book quotes.

Storm-season warning ad — “Protect before the storm hits”

A home insurance ad shows storm damage and coverage benefits.

Why it works:

- Uses urgency from seasonal risk

- Matches homeowner fears

- Hyper-local targeting improves relevance

- CTA directly tied to protection intent

How to use it: Run ads before storm season with weather images. Copy: “Don’t wait until it’s too late, then get a quote today.”

Coverage carousel — “What your home policy includes”

Cards highlight fire, flood, theft, and liability coverage.

Why it works:

- Clarifies abstract product

- Matches intent to compare benefits

- Visual breakdown increases clarity

- Builds trust through transparency

How to use it: Design 4–5 cards, each with an icon and short text. Final card: “See your coverage options — get a free quote.”

Local proof testimonial — “Why [City] trusts us”

An ad features a satisfied local customer with savings details.

Why it works:

- Social proof anchored in community

- Matches word-of-mouth intent

- Increases credibility

- Reduces buyer hesitation

How to use it: Share a customer review with their first name and city. Add CTA: “See why [City] drivers switch, get your free quote today.”

Medicare turning-65 form — “Explore your options at 65”

A lead form ad captures seniors’ details without leaving Facebook.

Why it works:

- Fits target life stage

- Simplifies sign-up process

- Matches “ready-to-shop” intent

- Builds pipeline of qualified leads

How to use it: Headline: “Turning 65 this year?” Add simple fields for contact info. Offer: free Medicare consultation in [City].

Medicare Advantage explainer video — “What’s new in 2026”

A 45-second Facebook video ad explains recent Medicare changes.

Why it works:

- Educational for seniors and families

- Builds trust through clarity

- Matches research stage intent

- Improves brand authority

How to use it: Record a short video with key updates. Add subtitles. CTA: “Schedule your free Medicare review today.”

Health insurance urgency ad — “Enrollment ends soon”

A countdown-themed image reminds users about open enrollment deadlines.

Why it works:

- Uses urgency psychology

- Matches deadline-driven decisions

- Fits seasonal search spikes

- Encourages quick action

How to use it: Pair a bold image with text: “Open Enrollment ends in 7 days.” Add CTA: “Don’t miss your coverage, get started now.”

Quiz-style lead ad — “Are you overpaying for insurance?”

A lead form feels like a quiz with 3 quick questions.

Why it works:

- Sparks curiosity

- Creates interactive engagement

- Collects qualifying info

- Matches comparison shopping intent

How to use it: Run copy: “Answer 3 questions to see if you’re paying too much.” Use lead form logic to auto-qualify prospects.

Customer review ad — “I saved $500/year with [Agency]”

A testimonial screenshot acts as the creative itself.

Why it works:

- Builds trust through peer validation

- Extremely low production effort

- Matches intent for social proof

- Anchors benefit in real numbers

How to use it: Share a short review with star rating visual. Add CTA: “See how much you can save — get your quote today.”

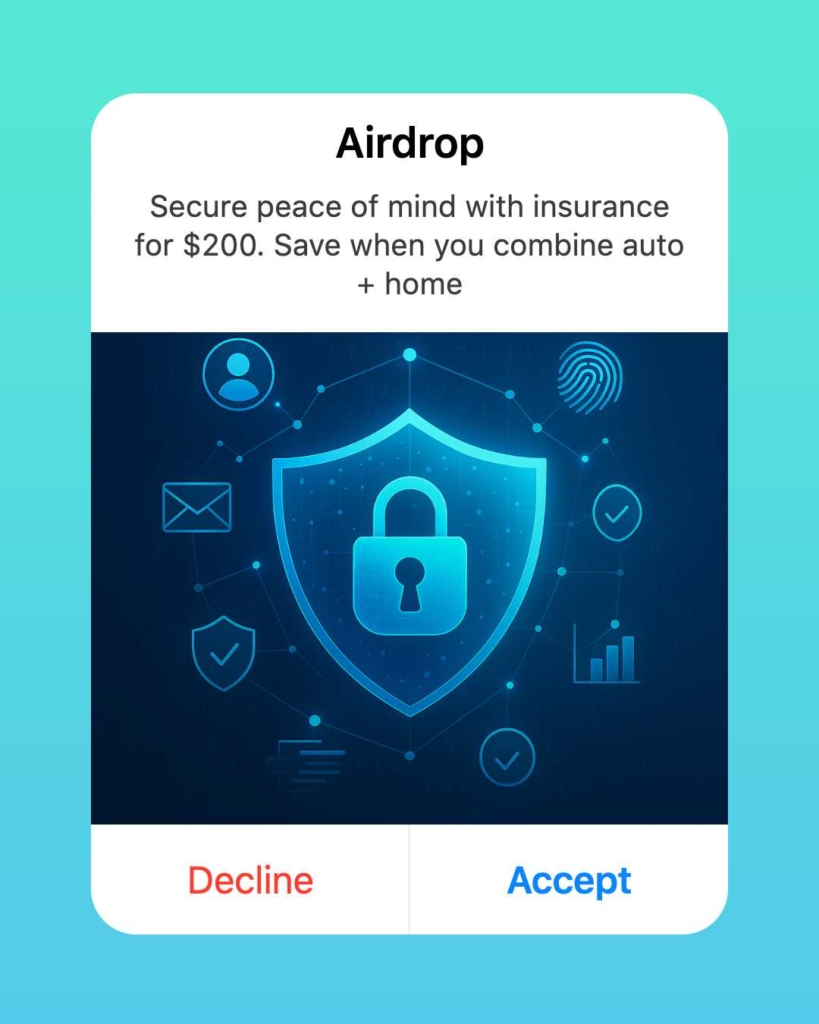

Bundle policy discount ad — “Save when you combine auto + home”

An image ad promotes multi-policy discounts for households.

Why it works:

- Appeals to savings-driven buyers

- Cross-sells existing customers

- Matches family budgeting intent

- Boosts revenue per customer

How to use it: Write copy like “Bundle your auto and home, save up to 20%.” Use a clean graphic showing combined coverage benefits.

4 steps of how to build a Facebook marketing strategy for insurance agents

When you’re running Facebook ads for insurance agents, it’s easy to get lost in the options. The truth is, you don’t need complicated funnels or a massive budget to make it work. What you need is a simple, disciplined system that keeps your targeting sharp, your creative fresh, and your follow-up fast.

Here’s how to put that strategy together step by step.

Step 1: Define your focus clearly

Start by narrowing down your offer. Choose one product line (auto, life, home, or Medicare), one geography (like your city or county), and one core offer (discount, free consultation, or bundle). This keeps your message from becoming watered down. Add a pre-qualifying detail in your copy, like “Homeowners in [City]” or “Turning 65 this year,” so you attract prospects who actually fit. Always pair this with a speed-to-lead SOP: call, text, or email within 5 minutes of a new lead. That window can be the difference between winning a policy and losing it.

Step 2: Target smart, not wide

Neil Patel says it best: “Audience targeting is more important than ad creative when it comes to creating Facebook ads that convert.”

Begin with your warmest audiences: upload your customer list, retarget visitors from your website, and re-engage people who have interacted with your Facebook page. From there, layer on a geo radius around your office to keep the audience local. Test one life-event signal, such as “recently moved” or “new job.” Then create a 1–2% lookalike audience based on people who actually purchased policies or called in. This builds quality from day one.

Step 3: Build your creative system

Don’t rely on a single ad. Create a matrix of 3 angles by 3 visuals. For example:

- Angle 1: Savings

- Angle 2: Security

- Angle 3: Service

Match each angle with three creative formats: image, video, carousel. That gives you 9 unique ads to rotate. Always include at least one video per angle, since videos outperform static posts in attention and engagement. Refresh weekly to prevent ad fatigue.

Step 4: Measure what matters

It’s not enough to count clicks. Install the Facebook Pixel and set up the Conversions API to track performance even when users opt out of cookies. Connect your CRM to feed in offline conversions, so you know which leads became actual policies. Add call tracking to capture mobile-driven calls and tie them back to campaigns. As Buffer notes, “We dug into the engagement rate data of eight social media platforms.” The real insight comes when you track not just engagement, but which engagements translate into revenue.

Pitfalls and professional advice on hidden facts about Facebook marketing for insurance agents

Running Facebook ads for insurance agents can feel simple on the surface, but most campaigns fail for the same hidden reasons. The mistakes aren’t always about ad design or budget size. They’re about ignoring the details that turn a lead into a policy. If you want your campaigns to work in 2026, here are the pitfalls you need to avoid—and the smarter ways to handle them.

Lead quality matters more than volume

It’s tempting to celebrate when you collect 100 leads from Facebook lead ads for insurance, but what if only two ever answer your calls? That’s a wasted budget.

The hidden truth is that volume means nothing without qualification. You should add custom questions to filter prospects: “Are you a homeowner?” “Do you need coverage above $100,000?” “What’s your date of birth?” Even one or two pre-qualifiers can improve lead quality dramatically. Pair this with CRM alerts so you or your team call back in under 5 minutes. That small window often determines whether the lead is still shopping or already gone with a competitor.

The danger of over-automation

Meta wants you to use Advantage+ campaigns, but small business advertisers often discover that automation burns through cash.

Automated placements and bids aren’t always aligned with your real goals. The pro tip here is simple: run Advantage+ in parallel, but keep at least one manual ad set live. Use cost caps, set daily budget ceilings, and build a clear kill/keep rule — pause losers, scale winners, check every 48 hours. That keeps you in control.

Policy and targeting changes

Facebook’s platform is not static. “On January 15, 2024, Meta removed and consolidated some granular ad targeting options.” If you’re not paying attention, your best-performing audience can disappear overnight.

To protect your results, rebuild saved audiences quarterly. Refresh your life-event signals and check your targeting for compliance. Treat this as routine maintenance, just like updating your CRM.

Don’t trust ROAS at face value

Many agents chase return on ad spend as their north star. But as Adweek uncovered, “…return on ad spend (ROAS) from Shops ads had been inflated between 17% and 19%.” That’s a red flag.

You should treat ROAS as a directional metric, not a final truth. The real performance signal is incremental lift: how many quotes, appointments, and policies your campaigns actually add. Track conversions offline through your CRM, and measure customer lifetime value, not just clicks or impressions.

By avoiding these pitfalls, you’ll stop wasting money on vanity metrics and build a system that consistently delivers policies, not just leads.

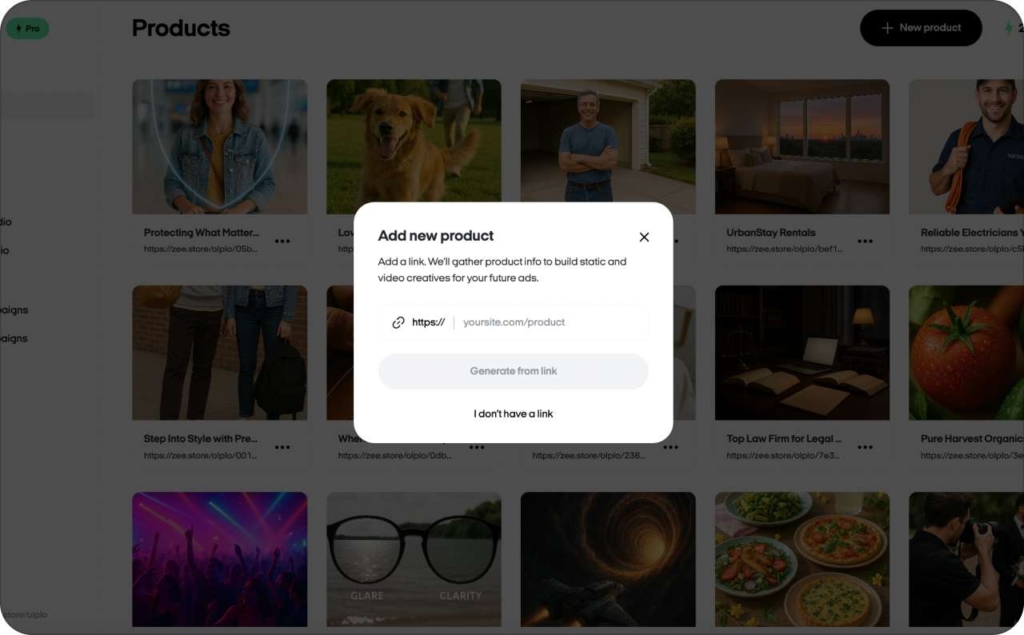

How to start a Facebook insurance campaign with an AI ad generator

You don’t need to spend weeks crafting designs or hiring freelancers to build your first campaign. With tools like Zeely, you can launch professional insurance Facebook ads in minutes and use AI for Facebook ads optimization. The platform takes your product link, brand kit, and campaign goals, then generates ad copy, visuals, and even video scripts tailored to your audience.

This matters for you as an insurance agent because time is money. The faster you test your offers, the faster you find what converts. Let’s break down the exact steps using Zeely’s system.

Step 1: Add your product link or Shopify store

Paste your product or service URL into Zeely. The AI automatically pulls key details — names, visuals, and descriptions. No manual copy-paste. This is especially useful if you have multiple insurance product pages (auto, life, home, Medicare). You can feed them directly into the AI and get tailored ad drafts.

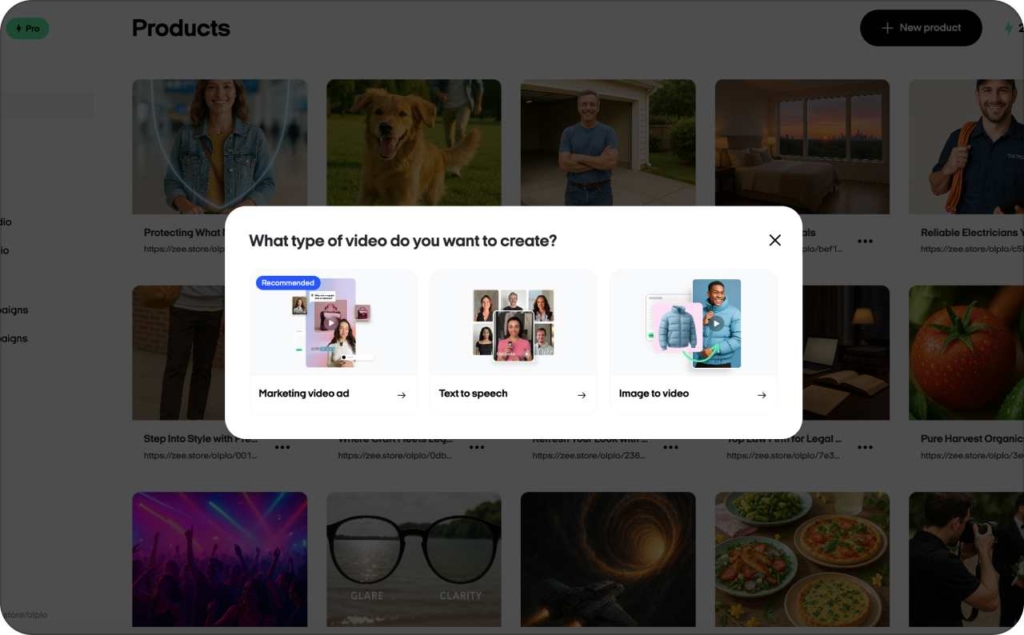

Step 2: Choose your ad format

Pick from static ads, video ads, or avatars. Each serves a different purpose:

- AI static ads are quick for direct offers (e.g., “Get a free quote today”)

- Video ads tell stories, which is perfect for life or Medicare insurance

- Avatars add a human-like spokesperson that can deliver your pitch

Match the right format to your funnel stage without overthinking design.

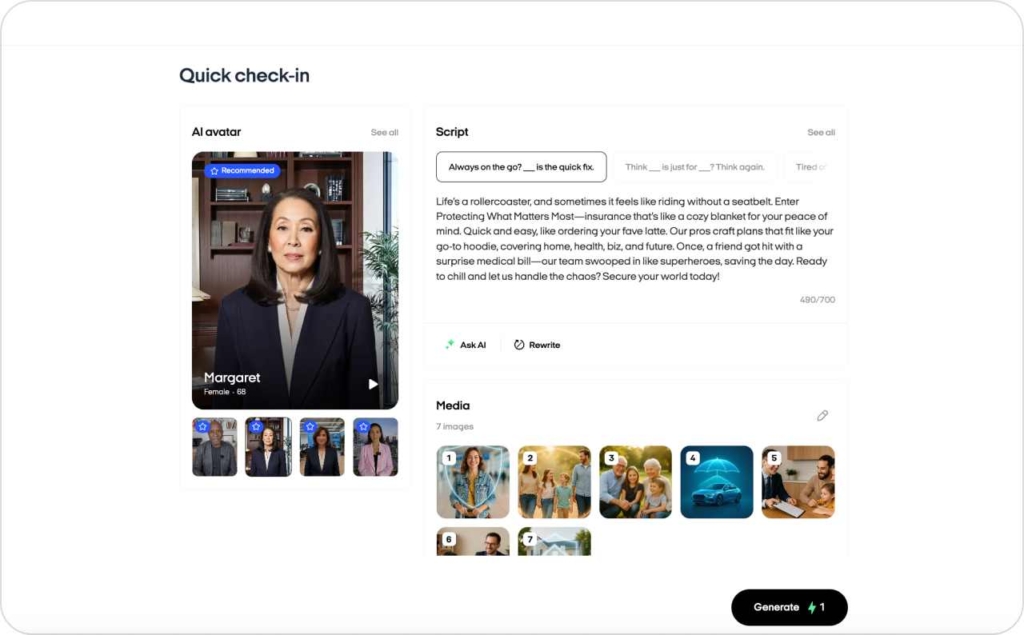

Step 3: Let AI generate ad copy and visuals

Zeely’s AI script tool and design engine create ready-to-use ad creatives. You get hooks, CTAs, and visuals crafted for engagement. Multiple conversion-focused variations without bottlenecks. You avoid creative fatigue by having fresh options at scale.

Step 4: Quick-edit your brand look

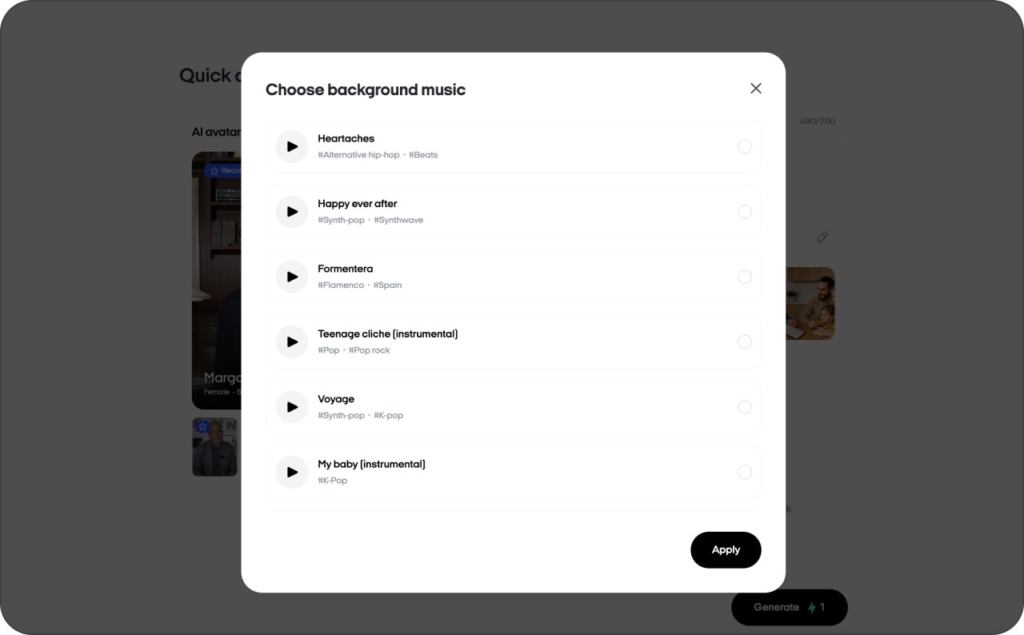

Use your brand kit inside Zeely: adjust colors, fonts, and even add music for Facebook video ads. Every ad stays consistent with your agency identity. This reinforces trust, critical for regulated products like insurance.

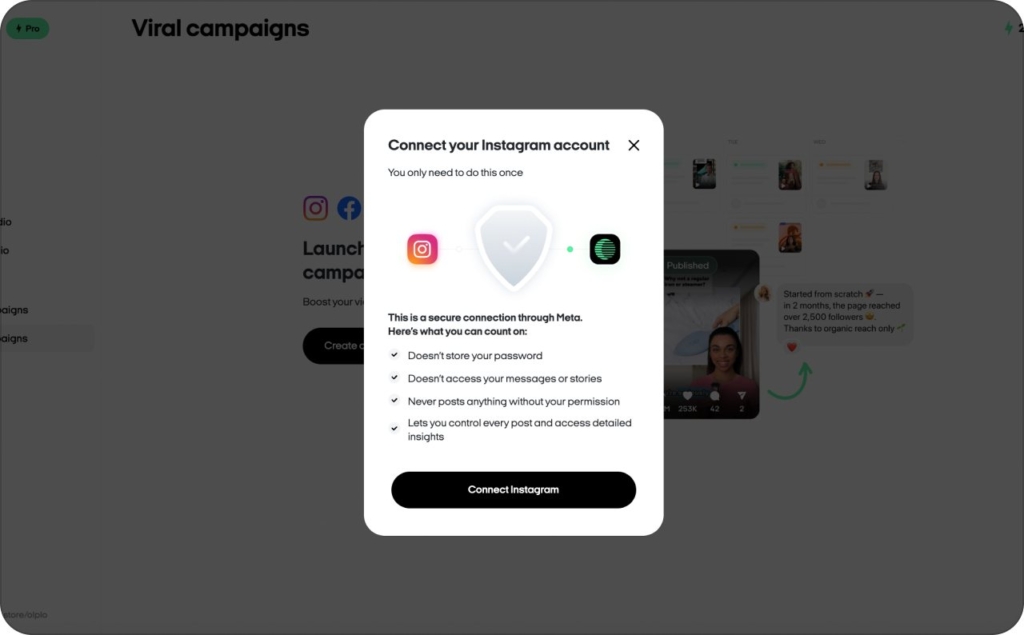

Step 5: Launch with Meta integration

Zeely connects directly to Meta Ads Manager. You can push ads live on Facebook and Instagram without exporting files. Tracking parameters are added automatically. Less technical hassle, faster time-to-market.

Step 6: Generate bulk ads for testing

Using Batch Mode, you can create hundreds of ad variations at once. Run A/B tests across different hooks, visuals, and offers. This is the fastest way to discover which angle — savings, security, or service — gets you the best cost per lead.

Zeely also includes AI hooks and CTAs, Shopify integration, and 24/7 support — features that help you stay agile while focusing on what matters most: closing policies.

Why AI makes the difference

Traditional ad creation can take days or weeks. AI reduces that to minutes. TechCrunch confirms, “Meta’s AI tools for advertisers can now create full new images, not just new backgrounds.” When paired with insurance targeting and lead forms, this speed means you can outpace competitors who still rely on manual creatives.

Launching Facebook insurance campaigns with AI saves you time, lowers creative costs, and increases conversion rates. With Zeely, you move from idea to live ads in minutes. That means more testing, faster learning, and higher ROI — all without the overhead of big marketing teams.

You may also like

Also recommended