Bank advertising that works: 5 proven formats to build trust and drive ROI

How do leading banks turn trust into measurable growth? Zeely AI reveals five proven ad formats that build credibility and deliver strong ROI.

Most banks advertise to meet requirements. The smart ones advertise to win market share. In a space built on trust and dominated by parity products, creative advertising is the only differentiator banks fully control. Whether you’re launching a credit card, promoting community lending, or scaling digital acquisition, the right campaign can shift perception, drive growth, and build long-term loyalty. This guide breaks down what separates high-performing bank ads from wasted spend and how to design campaigns that earn belief before the first click.

Why bank ads must build trust from the start

Customers won’t engage if they don’t feel safe. The best bank marketing strategies begin with design choices that feel human. Visual consistency, natural language, and customer-first framing create trust-building ads that reduce friction and deepen connection.

Whether you’re running personalized banking marketing, promoting community bank services, or launching targeted Google Ads, the first impression must signal integrity. Trust is what earns the click.

Creative techniques behind memorable bank ads

The best bank marketing strategies inform and connect. By combining visual clarity with emotional cues, banks can design ads that stand out, feel human, and build trust fast.

Use visual metaphors to simplify complex services

Visual metaphors help translate financial concepts into something people can feel. Turning abstract terms like “escrow” or “interest” into symbolic, everyday visuals makes the offer easier to grasp and harder to forget. This technique improves digital campaign clarity and supports customer engagement.

Rely on minimalism to increase clarity

In financial advertising, less often converts better. Three-word copy, high contrast, and clean space help focus attention on what matters: safety, transparency, or control. Minimalist ads load faster, perform better on mobile, and align with digital marketing best practices for banks.

Center campaigns around human stories

Banks that lead with customer emotion outperform those that lead with product features. Imagery focused on families, everyday financial decisions, or life milestones strengthens brand trust. Story-driven visuals help banks deepen customer relationships while improving retention through relevance.

5 proven advertising formats for banks

Every effective bank marketing strategy depends not only on message quality, but also on format precision. The right delivery channel amplifies trust signals, boosts discoverability, and improves conversion outcomes across the entire funnel. Below are five advertising formats that consistently deliver results for financial institutions of all sizes.

Display and banner ads

Display ads remain a core tool in digital marketing for banks. They allow rapid reach across high-traffic websites and financial content networks. When designed with strong color contrast, bold typography, and clear visual hierarchy, they increase brand recall and drive traffic to landing pages or product portals.

Used in retargeting, they help recapture drop-offs. In prospecting, they introduce your institution to cold audiences. Display ads also support Google Ads targeting, making them essential for both awareness and acquisition campaigns.

Digital content pieces

Educational content builds authority and long-term visibility. Banks that invest in content marketing — blogs, video explainers, savings calculators, or downloadable guides, attract intent-driven users and strengthen organic positioning in search engines.

This format allows banks to demonstrate expertise, answer common objections, and improve SEO for local and national searches. Effective content campaigns lead to increased session time, more conversions, and better customer retention through ongoing value.

Email campaigns and PPC

Email remains the highest-ROI channel for many banks. Personalized campaigns that reflect behavior — abandoned forms, product interest, previous interactions, outperform generic blasts. Time-sensitive messages tied to loan offers, rate changes, or account upgrades drive instant response.

Paired with PPC advertising, banks can run targeted Google Ads linked to hyper-relevant landing pages. This duo excels in customized marketing funnels, where speed, segmentation, and urgency combine to deliver action.

Social ads and campaigns

Social media ads offer a platform for community bank marketing and narrative-driven growth. Campaigns centered on financial empowerment, community impact, or customer stories earn stronger engagement than product-centric posts.

These ads are ideal for localized outreach, especially when paired with online reviews, user-generated content, and regional offers. They increase brand warmth, promote trust-building, and give banks a distinct voice within crowded feeds.

Multi-channel integrated campaigns

No single channel can carry a campaign alone. Integrated efforts combine the precision of PPC, the depth of content, the emotional impact of social, and the direct targeting of email into a single strategic framework.

Successful bank growth strategies align messaging, visual identity, and timing across platforms. This ensures customers receive consistent cues, whether they’re browsing, searching, or scrolling, strengthening brand credibility, deepening customer relationships, and improving ROI over time.

Emotional triggers that work in banking ads

Emotion is a performance lever in bank advertising. People choose financial services based on how a brand makes them feel. Trust, urgency, belonging, and pride are conversion tools that strengthen any bank marketing strategy.

Trust: The foundation of financial advertising

Without trust, conversion doesn’t happen. In finance, credibility is non-negotiable.

Trust-driven ads typically use:

- Real testimonials from existing customers

- Transparent messaging that avoids fine print or vague claims

- Security cues, like FDIC insurance, encryption mentions, or fraud protection

These elements reduce anxiety, increase click-through rates, and strengthen customer retention. Trust is also reinforced through consistent design — same colors, tone, and logo use across digital touchpoints.

Instant gratification: Tap into urgency

People respond to speed, especially when financial products promise fast access or exclusive benefits.

Effective tactics include:

- Limited-time offers for new checking accounts, loan approvals, or referral bonuses

- “Apply in minutes” headlines paired with high-contrast CTAs

- Countdown timers in email and display ads to intensify urgency

This emotional trigger works well in PPC advertising and email campaigns, especially when paired with personalized banking marketing.

Belonging: Strengthen local and cultural relevance

Consumers trust brands that reflect their values, communities, and identity. Emotional proximity builds loyalty.

To activate belonging:

- Use imagery from local events, regional landmarks, or diverse communities

- Feature real customer stories that reflect shared experiences

- Highlight involvement in community partnerships, volunteer programs, or small business sponsorships

This approach is highly effective for community bank marketing, where local SEO, reviews, and cultural awareness drive engagement.

Pride: Connect to aspirational identity

Pride is the reward emotion, linked to achievement, growth, and financial independence.

Bank ads that trigger pride often:

- Show customers reaching goals

- Position smart financial choices as milestones worth celebrating

- Use lifestyle visuals and empowering copy like “You earned this” or “Built, not borrowed”

This messaging supports brand authority and encourages customers to identify with success and your institution as the enabler.

Strategic & design best practices

Strong creative is more than aesthetic, it’s functional. Every visual decision in bank advertising carries weight. Color, typography, layout, and language signal credibility or confusion, trust or doubt. The following principles help banks align visual design with performance goals and audience expectations.

Use color psychology to reinforce emotion

In financial marketing, color guides emotion, brand tone, and trust perception. Blue conveys security and stability, green signals growth and wealth, while red is used selectively for urgency or alerts.

Too many banks default to the same palette. Differentiation comes from combining color psychology with brand-specific identity. Consistency across display, social, email, and landing pages builds visual trust and supports customer retention.

Prioritize legibility with strategic typography

Typography affects how quickly messages are absorbed. Clear, modern fonts with proper spacing and hierarchy improve comprehension across devices. Headlines should be bold, short, and immediate. Body text must be readable on both mobile and desktop.

Avoid decorative fonts or overly stylized type. In digital marketing for banks, clarity outperforms creativity when it comes to type.

Use visual storytelling to humanize abstract services

Banks deal in intangible value — safety, time, growth. That makes visual storytelling essential. Metaphors simplify complex ideas. Human imagery adds emotion. Minimal layouts help the core message stand out.

Combining symbolic visuals with simple, focused layouts builds digital presence and drives emotional engagement. This is especially effective in content, social, and homepage hero designs.

Keep calls-to-action clear and actionable

A strong ad without a clear CTA underperforms. Use short, direct phrases: “Apply now,” “Compare plans,” or “Check rates.” Avoid vague language like “Learn more” unless it’s paired with context. Button contrast, size, and placement must guide the eye immediately.

CTAs should reflect user intent and match the ad promise. In PPC campaigns and email marketing, unclear or buried CTAs directly reduce conversion rates.

Performance & optimization

A campaign that looks good but lacks measurement is a missed opportunity. The most effective bank marketing strategies combine design execution with continuous performance analysis. Whether you’re running SEO content, PPC ads, or email funnels, optimization begins with data.

Combine SEO, PPC, and content targeting

Integrated campaigns outperform channel silos. SEO for banks improves visibility during the research phase, PPC advertising captures bottom-of-funnel demand, and content targeting nurtures engagement in between. The interplay of these tactics allows banks to meet different intent levels with aligned messaging.

Keyword alignment across paid and organic channels reduces waste and improves ROI. Landing pages that serve both SEO and paid traffic reinforce trust, reduce bounce rates, and boost relevance scores in ad platforms.

Use data to drive creative and targeting decisions

Optimization doesn’t end at launch. Campaign performance improves through structured testing, analytics, and feedback loops.

Key actions include:

- A/B testing ad creative, copy, CTA placement, and landing page design

- Behavioral segmentation based on prior engagement, location, or device

- Personalization using CRM or analytics data to tailor offers by audience type

Every ad format, display, search, email, or social, should be tracked against conversion benchmarks, not vanity metrics. Metrics like cost-per-acquisition, click-to-lead rate, and engagement depth guide real improvements, not guesswork.

Align with user intent and funnel stage

High-performing campaigns map messaging to behavior. First-time visitors need clarity and reassurance. Returning users respond to urgency, social proof, or personalized offers. Aligning creative with customer journey stages ensures resources are spent where impact is highest.

This approach mirrors data-driven marketing models used across top-performing financial institutions and reflects how modern banks scale performance without losing relevance.

Case studies of bank advertising campaigns

Bank advertising is judged by outcomes — brand lift, customer acquisition, retention, and trust recovery. These campaigns show how financial institutions applied clear positioning, emotional relevance, and format discipline to achieve measurable results. Each example highlights a specific objective, whether it was launching a premium product, repairing reputation, or building digital loyalty and the creative choices that made it work.

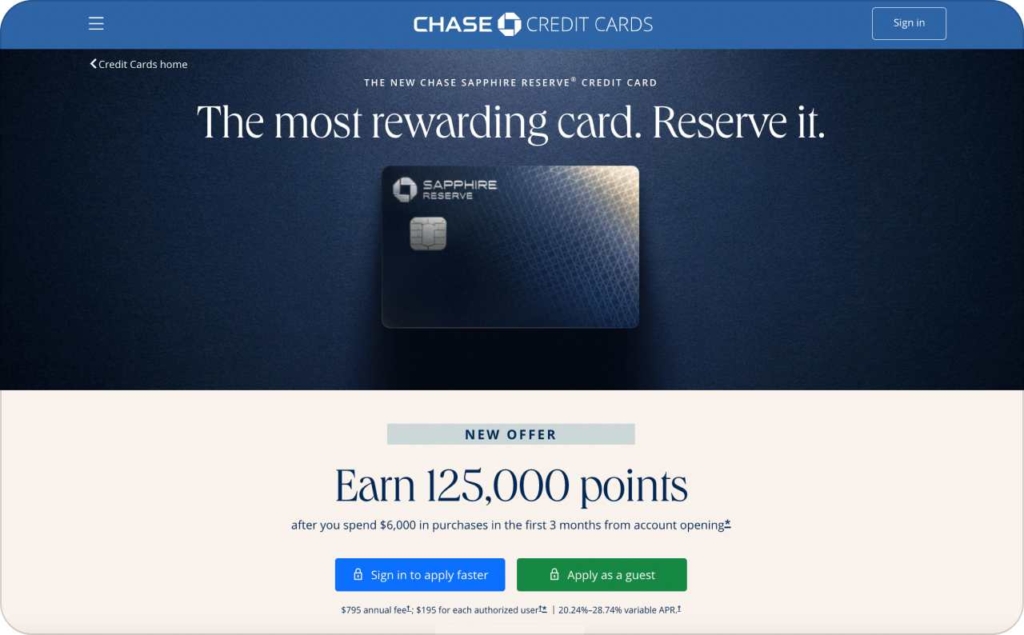

Chase x Sapphire Reserve: Turning travel perks into social currency

To launch its premium Sapphire Reserve card, Chase targeted affluent Millennials with a bold 100,000-point bonus and a focus on lifestyle-driven rewards. The campaign promoted luxury travel benefits, like airport lounge access, trip protections, and dining perks, using a mix of digital channels, influencer buzz, and organic social momentum from early adopters.

Photo source: Chase Bank

Results:

- Met 12-month acquisition targets in just 2 weeks

- Over 90% cardholder retention after Year 1

- Average annual spend of $39,000 per cardholder

- Rapid adoption among under-35 consumers, especially Millennials

Why it worked:

It positioned financial products as lifestyle enablers. By framing premium banking as access to exclusive experiences, Chase tapped into aspiration, status, and community-driven brand engagement.

Wells Fargo: Rebuilding brand trust through transparency

In response to public trust erosion after internal scandals, Wells Fargo launched the “Building Better Every Day” campaign to reset consumer perception. The campaign emphasized ethical reform, renewed customer service standards, and visible community investment, delivered through TV spots, digital ads, and in-person outreach.

Results:

- National brand sentiment lifted after a two-year decline

- Increase in community program participation and local press coverage

- Higher engagement across brand-owned digital platforms

- Campaign cited as a trust-rebuilding benchmark by financial media outlets

Why it worked:

It addressed reputation damage directly without spin. By showing behind-the-scenes improvements and committing to measurable action, the campaign focused on trust-building over product-promotion, helping the bank re-establish relevance through accountability and local connection.

Bank of America: Humanizing digital banking through connection

Bank of America’s “Life’s Better When We’re Connected” campaign spotlighted the personal side of finance. The messaging centered on meaningful customer relationships, personalized banking tools, and seamless digital access, positioning the bank as a long-term financial partner, not just a service provider.

Delivered through national TV, social media, and digital content, the campaign emphasized emotional connection while showcasing the bank’s evolving digital capabilities.

Photo source: Matthew T Rader

Results:

- Increased digital engagement across mobile and online platforms

- Strengthened perception as a customer-first institution in third-party brand studies

- Positive uplift in brand sentiment among Gen X and Millennial segments

- Boost in cross-channel retention among digitally active customers

Why it worked:

It bridged tech and trust. By connecting high-tech banking tools with personal stories and everyday financial goals, Bank of America reinforced its relevance in both emotional and practical terms, strengthening brand loyalty through human-centered messaging.

Ally Bank: Redefining modern banking with customer-first transparency

The “Do It Right” campaign by Ally Bank positioned the brand as a tech-forward, customer-obsessed alternative to traditional institutions. The message focused on radical transparency, ease of use, and always-on support, appealing to digital-first consumers seeking control and clarity in their banking experience.

Core promises included no hidden fees, competitive interest rates, and 24/7 customer service. The campaign was delivered through witty digital ads, engaging social media storytelling, and educational content aimed at demystifying financial topics.

Results:

- Significant lift in brand preference among Gen Z and Millennial customers

- Increased digital account openings in direct response to campaign touchpoints

- Boost in social media engagement from customer-focused messaging

- Strengthened brand identity as a challenger in the consumer banking space

Why it worked:

It made trust tactical. By turning transparency and simplicity into market differentiators, Ally proved that ethical, digital-first banking could be both accessible and profitable, winning attention through clarity, not complexity.

Capital One: Building brand recall with humor and celebrity power

Capital One’s long-running “What’s in Your Wallet?” campaign fused entertainment with financial messaging to build one of the most recognizable slogans in banking. Featuring high-profile personalities like Jennifer Garner and Samuel L. Jackson, the campaign brought attention to Capital One’s credit card benefits through humor, repetition, and relatable scenarios.

The messaging emphasized rewards, ease of use, and customer-first perks, anchored in TV spots, digital videos, and national ad placements that appealed across demographics.

Results:

- One of the most recognized taglines in U.S. financial advertising

- Significant growth in cardholder acquisition during campaign years

- Strong brand association with rewards and ease of approval

- Expanded reach across traditional and digital media ecosystems

Why it worked:

It combined clarity with personality. By using consistent messaging, relatable value props, and memorable spokespeople, Capital One reinforced its brand in both emotional and functional terms, delivering a campaign that entertained, informed, and converted.

Why you need an AI ad generator for bank ad creation

Creating high-performing financial advisor ads and bank ads takes time, creative precision, and platform expertise. Most institutions don’t have hours to test formats or budget to outsource every campaign. That’s where an AI ad generator like Zeely becomes essential.

The Zeely app is a smart AI ad maker built for fast, automated ad creation. It helps banks and financial brands produce ready-to-launch static and video ads in minutes, designed to convert, scale, and align with platform best practices. Whether you’re running Meta ads, launching Shopify integrations, or testing new offers, Zeely turns complex campaign execution into simple, repeatable workflows.

See creative solutions for other industries

Key benefits of using Zeely for bank ads

- Automated ad creation in minutes. Generate static and video ad creatives instantly, choose one of 100+ templates for static ads or one of 150+ AI avatars for video ads

- Built-in campaign logic for Meta and Shopify. Launch high-converting ads pre-optimized for Meta Ads Manager and Shopify sales flows

- Save hours on repetitive asset production. Focus on strategy while Zeely handles the creative and formatting for you

- Boost ROI with data-backed formats. Every ad design is optimized for click-through, lead capture, and performance tracking

- Scale campaigns effortlessly across channels. Repurpose creative for multiple placements without extra cost or effort

- Simple enough for any team member to use. No learning curve. Just plug in your product or service, and Zeely builds the rest

Why it matters

In a competitive market, speed and consistency win. Zeely eliminates guesswork and gives banks a clear edge with fast, scalable, and automated ad creation that performs. If you want to save time, launch faster, and see real returns — the Zeely app is a must-have tool in your advertising stack.

Conclusion

The most successful bank ads shift behavior. They build trust on contact, tap into emotional relevance, and drive performance with measurable outcomes. As competition intensifies and attention fragments, banks can’t afford generic creative or fragmented messaging.

Winning teams commit to clarity, speed, and iteration. They use every tool — storytelling, segmentation, design, automation, to reduce friction and raise ROI. And with platforms like Zeely, they produce at scale without losing control.

Trust gets the click. Relevance earns the customer. Strategy keeps them. That’s how modern bank advertising grows business.

You may also like

Also recommended