Creative financial services ads: Real-life examples

Can finance ads be engaging and human? Zeely AI explores real-world examples of creative financial services advertising that build credibility while driving measurable growth.

When your financial ad looks great but violates a disclosure rule, it won’t just underperform, it could get pulled entirely. Financial services ads promote products like mortgages, credit cards, insurance policies, and digital banking tools. Unlike typical retail marketing, these ads must adhere to stringent regulations from authorities such as the SEC, FINRA, and the FCA, requiring accuracy, clarity, and compliance in every claim and disclosure.

Effective financial services ads don’t just highlight benefits, they explain them clearly, include prominent disclaimers, and reflect transparency, compliance, and consumer trust from the first impression.

Learn how to craft compliance-driven yet visually engaging campaigns across digital channels. Discover how to merge storytelling with accurate disclosures, measure performance using metrics like CPA and CTR, and apply digital strategies without breaching regulatory boundaries.

What makes these ads work?

Creative financial ads perform because they earn attention and trust. Let’s break that down:

Personalized stories make products feel human

A static rate table rarely inspires. But a home loan ad that features a real couple unlocking their first home, complete with a story about budgeting, approval, and family goals, connects on a deeper level.

This approach isn’t just feel-good marketing. Personalization increases relevance, and relevance drives ROI. According to a McKinsey report, companies that excel at personalization generate 40% more revenue than those that don’t. In finance, that means tailoring messages to life stages, while aligning copy and creative with user intent and compliance requirements.

Clear visuals and disclosures build credibility

Financial ads can’t afford confusion. Brands like American Express and Chase use high-end visuals, think beach resorts or luxury lounges, to sell credit card travel perks. But the creativity doesn’t stop there. Disclaimers about blackout dates, point conversion rules, and annual fees are placed prominently, often within the first fold or frame.

This not only aligns with SEC and FTC advertising standards, but also reinforces brand transparency. The most effective creatives avoid legal jargon in favor of plain language — “No hidden fees,” “Terms apply,” or “See how points add up.”

Video formats lift performance

You’ve probably noticed more mobile-first finance ads using short-form video or explainer clips. That’s no accident, Ad Spend Report projects digital video to exceed $72 billion this year, with financial services among the fastest adopters.

Why? Because finance is complex, and motion simplifies complexity. Whether it’s a 15-second TikTok explainer showing how to open a high-yield savings account or a 30-second Instagram story on loan approval steps, video allows you to walk viewers through your offer, visually integrate disclaimers, and keep them engaged with storytelling.

According to Deloitte, 2025 Financial Services Outlook, 62% of banking ad budgets are now digital-first, with mobile, social, and programmatic ads leading the way. The takeaway? If you’re not building creative for platform-native formats with vertical layouts, real-time targeting, and embedded disclosures, you’re leaving ROI on the table.

Why compliance doesn’t kill creativity

If you think compliance restricts creativity, you’re looking at it backwards. Regulations give you the framework. Great financial ads thrive inside it.

- Disclaimers and legal clarity don’t break flow, they build trust

- Well-placed APR disclosures or T&Cs protect your campaign and enhance brand credibility

- Brands like Rocket Mortgage and Monzo design around FCA and SEC rules, using proven frameworks that still allow space for storytelling and personalization

By integrating compliance at the concept stage, you protect both performance and reputation.

Creative financial services ad examples

Home loan advertisements

Home loan ads compete in one of the most expensive digital ad categories. With CPCs ranging from $18 to $30, financial advertisers must earn attention and trust in seconds. Storytelling isn’t a luxury, it’s your conversion advantage.

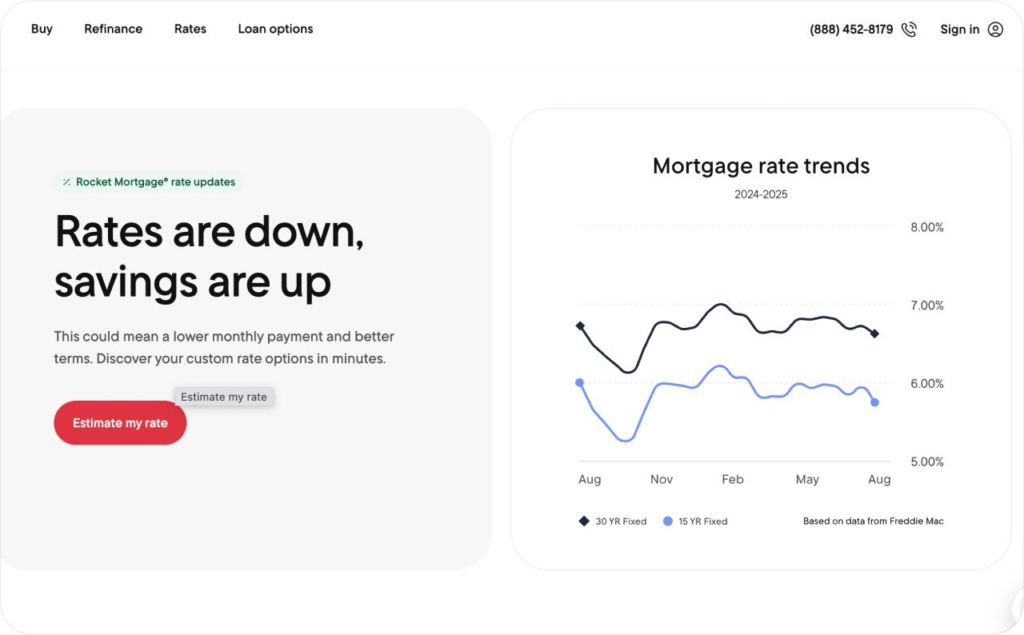

Rocket Mortgage — simplicity that converts

Rocket Mortgage sets the benchmark for simplifying the complex. Its creative strategy pairs emotional storytelling with seamless digital usability, proving that performance doesn’t come at the cost of clarity.

Campaign highlight: “Own the dream” Super Bowl strategy

In 2025, Rocket Mortgage aired its “Own the dream” campaign during Super Bowl LIX — a bold, emotionally charged activation. Set to John Denver’s “Take me home, country roads,” the campaign used nostalgia and national pride to reframe homeownership as a path to generational wealth, not just a transaction.

The execution was multi-layered:

- A live stadium singalong at the Caesars Superdome with over 65,000 fans created real-time unity

- A national TV broadcast extended the emotional reach

- A brand manifesto video and a company-wide brand refresh tied together all Rocket products under a single vision

It wasn’t just theatrics. With $824 million in ad spend in 2024, Rocket demonstrated its category leadership and commitment to cultural impact. The campaign amplified Rocket’s mission: making the dream of homeownership feel attainable and inclusive.

Digital execution: Frictionless, outcome-focused conversion

Beyond brand building, Rocket’s digital performance strategy is a masterclass in clarity and intent:

- Conversion-optimized website with actionable, benefit-driven CTAs like “Save up to $10,000” and “Get 0.5% back”

- Streamlined application funnel that only requests essential data reducing drop-off and boosting completions

- Massive organic reach through content: their “Learn” hub alone attracts 1.4 million organic visits/month, making up 60% of total SEO traffic

What sets Rocket apart digitally is its obsessive focus on outcome messaging. Instead of vague CTAs like “Apply now,” the user journey is guided by specific, customer-aligned value. And with CTAs placed at conversion-critical moments, users are never far from the next step.

“Real talk” and the push toward emotional branding

Rocket Mortgage didn’t stop at clarity and simplicity, they aimed to inject humanity into the mortgage experience. The “Real talk” campaign marked a strategic pivot from product-led messaging to emotionally resonant storytelling, attempting to position Rocket not just as a lender, but as a listener.

Campaign strategy: Humanizing a traditionally cold industry

The financial industry often suffers from a reputation for being impersonal. Rocket challenged this with a campaign that sought to show empathy and connection. “Real talk” framed Rocket as a brand with soul, compassionate, attentive, and emotionally in tune with the real fears, frustrations, and dreams of homebuyers.

Through a series of conversational videos, the campaign highlighted moments where buyers expressed genuine concerns, ranging from affordability confusion to stress over approvals, and had Rocket Mortgage executives respond thoughtfully. The goal was to create a brand persona that listens, understands, and cares.

Execution: Cross-platform empathy and accessibility

The campaign used a multi-channel rollout that blended TV, digital, and social components:

- Short-form videos were crafted specifically for mobile-first audiences, increasing resonance with younger, social-savvy homebuyers

- It extended into Rocket’s “Real solutions” platform — an educational microsite offering practical guides, tools, and next steps based on user needs

- Each ad segment served as both a trust-building moment and a gateway to deeper, more actionable digital content

While the campaign aimed for authenticity by showcasing “real” customer experiences, the reliance on scripted actors diluted the emotional credibility for some viewers.

Results: Emotional differentiation with a side of skepticism

The campaign did succeed in one major goal — brand differentiation. Rocket stood apart from competitors by making empathy part of its value proposition, reinforcing the company’s evolution from a transactional service to a values-driven partner in the homebuying journey.

However, audience reception was mixed:

- Positive: Many users appreciated the effort to show the emotional side of real estate financing

- Critical: Some viewers found the format overly polished, calling out the campaign as inauthentic due to the visible presence of actors and staged “realness.” This led to pockets of backlash, especially across social media

Still, despite this friction, the campaign successfully drove engagement and leads through Rocket’s digital platforms, especially the “Real solutions” hub. Time on site and conversion events saw a measurable boost.

Credit card & travel ads

Credit card ads sell a lifestyle wrapped in trust and clarity. In a high-CPC, saturated market, the right mix of aspiration and transparency sets your campaign apart.

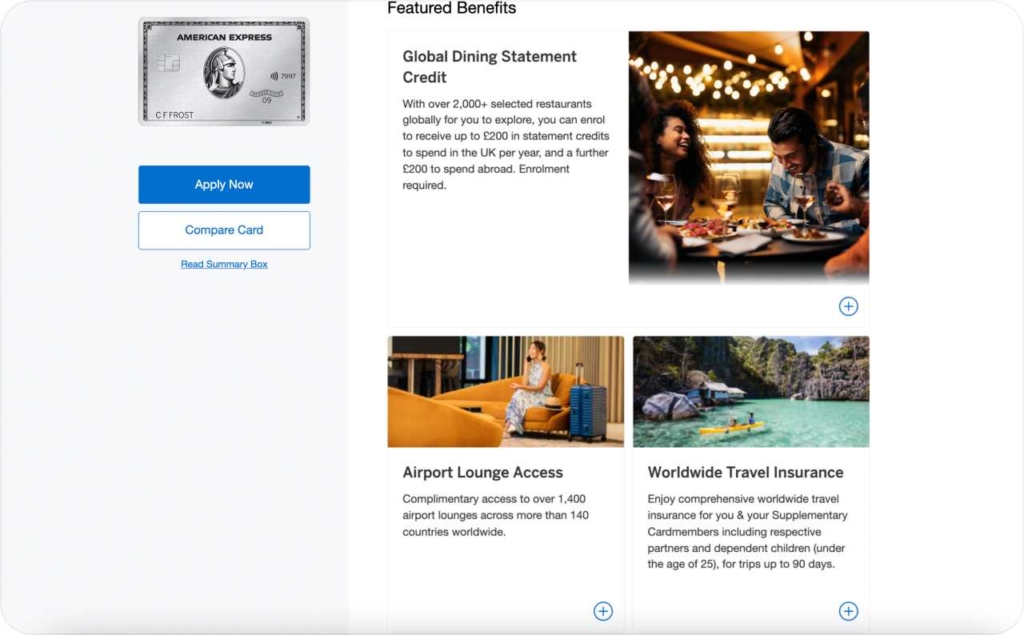

American Express Platinum — status, simplified

Strategy: Prestige positioning for high-value travelers

American Express Platinum doesn’t chase volume, it cultivates influence. Its core audience includes frequent flyers, affluent professionals, and experience-driven spenders. The pitch? Emotional equity over transactional perks. Every campaign message reinforces Platinum’s identity as a gateway to elevated living, not just rewards.

Campaign highlight: “Beyond the card” experience-first storytelling

Amex’s “Beyond the card” campaign redefined luxury engagement by centering on experiential access. Whether it’s private airport lounges or curated events, the goal was simple: associate Platinum with moments that money alone can’t buy.

The multi-channel execution included:

- Cinematic TV and CTV spots showcasing white-glove moments in travel and hospitality

- Reels and short-form video ads tailored for affluent mobile-first users

- Display retargeting ads localized by user behavior, using high-contrast minimalist creatives

The message stayed consistent: exclusive access, clearly disclosed. Even legal copy like “Enrollment required. Terms apply.” appeared in subtle overlays, preserving aesthetic while maintaining compliance.

Photo source: American Express

Digital execution: Platform-specific luxury at scale

On digital, Amex optimized aggressively. High-impact visuals were paired with precise calls to action like:

- “Access 1,400+ airport lounges worldwide”

- “$200 hotel credit — enrollment required”

Landing pages leaned on mobile responsiveness and simplified eligibility flows to minimize drop-offs. Dynamic creative optimization enabled real-time tailoring based on user behavior, geography, and spend patterns.

Results: Premium returns from precision and polish

Amex saw measurable impact across key performance indicators:

- 21% increase in ROAS from high-LTV travel segments

- CPC reductions via niche affinity targeting and optimized sequencing

- Application completion rate lifted significantly via mobile-native forms

By combining exclusivity with clarity, Amex Platinum positioned itself not just as a credit card, but a lifestyle upgrade.

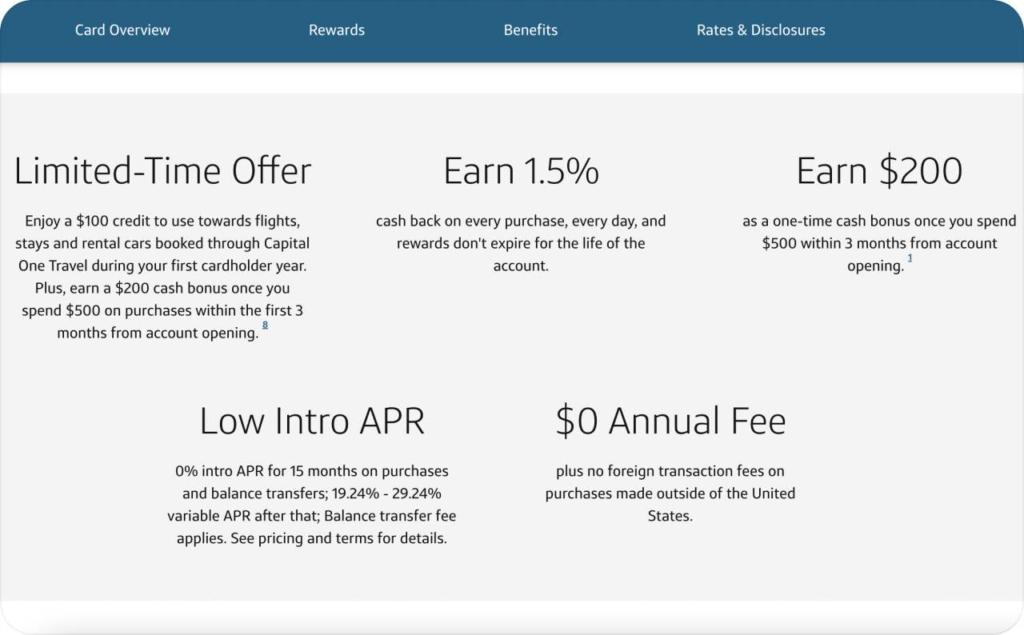

Capital One Quicksilver — trust through simplicity

Strategy: Everyday rewards for pragmatic spenders

Where Amex speaks to status, Quicksilver speaks to simplicity. Capital One focused on budget-conscious consumers who value flat-rate rewards and transparency. The proposition? One card, no gimmicks, consistent value.

Campaign strategy: Use-case storytelling in real life

Quicksilver’s creative approach leaned into everyday wins. Through short video vignettes, like morning coffee run, groceries, ride shares, the campaign showed where and how cashback adds up. Not hypotheticals, but relatable habits.

Featured messages included:

- “1.5% cashback on every purchase every time”

- “$0 annual fee. No categories to track”

Each ad balanced product features with compliance clarity, using caption overlays and static end frames with legal disclaimers.

Photo source: Capital One Quicksilver

Execution: Conversion-first with creative variation

Capital One scaled performance by embracing test-and-learn tactics:

- A/B testing carousel formats with lifestyle scenarios

- Prefilled mobile forms to reduce friction at the application stage

- Performance retargeting with short-form video, which outperformed static by 22%

Results: Simplicity that scales

The impact was both immediate and compounding:

- 19% increase in CTR from value-forward creative hooks

- 14% drop in application abandonment via prefilled flows

- Improved audience trust metrics in brand lift studies

Capital One’s clarity-first strategy proved that when rewards are easy to understand, trust and conversion follow.

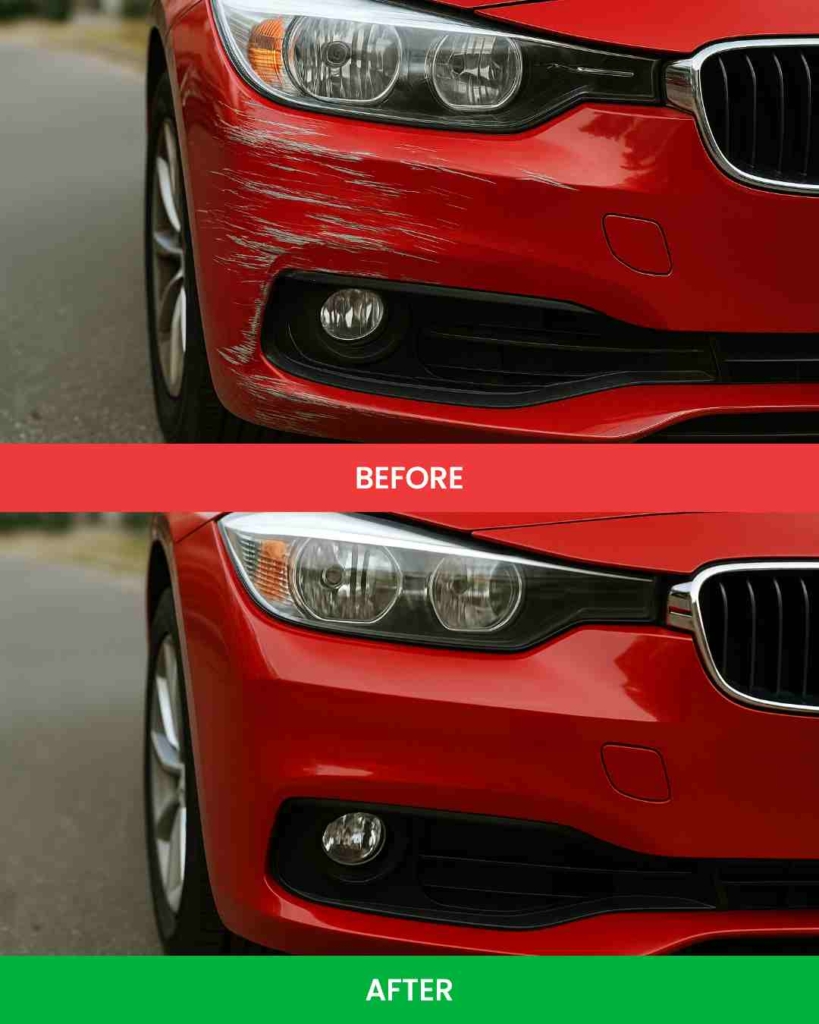

Insurance advertisements

Insurance ads that convert don’t focus on fear, they focus on reassurance. Static images still play a role, but short-form video and carousel formats consistently outperform in digital insurance campaigns.

State Farm — real-life protection narratives

Empathy meets everyday utility

State Farm’s creative strategy focuses on real-life events that policyholders actually face, like storm damage or car repairs, and reframes them as moments of reassurance, not anxiety. The brand avoids alarmist tones and instead leans into calm, confident storytelling.

Campaign highlight: “Here to help, always” cross-platform rollout

This multi-channel campaign used a blend of carousel ads and mobile-first videos to simulate everyday insurance scenarios. Each ad followed a simple story arc: incident → response → resolution.

Key creative elements:

- Realistic visuals of minor home and auto issues, avoiding dramatic overstatements

- Warm, familiar color palettes paired with affirming voiceovers “We’ve got you”

- Overlays clarify limitations upfront: “Coverage varies by state and situation”

- Narration and copy are benefits-first — less on exclusions, more on outcomes

Photo source: Event Marketer

Digital execution: Actionable and compliant

On the digital side, State Farm streamlined the post-click experience to match ad messaging. Landing pages load quickly, pre-fill based on location, and echo the same visual tone as the ad content.

Performance wins:

- 16–20% CTR lift on Facebook and YouTube mobile placements

- 12% drop in bounce rates for quote-focused landing pages

- Brand favorability scores increased by 9 points in pre/post lift studies

This campaign’s power wasn’t just in storytelling, it was in the clarity of the digital handoff. The emotional narrative primed users to convert by removing friction and focusing on real outcomes.

Lemonade — radical clarity and digital-first value

Insurance, stripped to the essentials

Lemonade’s marketing strips away legacy insurance complexity. The brand leads with speed, transparency, and user control visually and verbally. Its minimalist aesthetic appeals to digital-native consumers who expect clean design and fast answers.

Campaign highlight: “90 seconds to coverage” interactive journey

This campaign launched across Instagram Reels, TikTok, and programmatic display, pairing animated carousels with ultra-short headline copy. Each frame delivered one promise, one icon, and one clear CTA.

Creative execution:

- Bright backgrounds and high-contrast animation for instant scroll-stopping impact

- CTAs like “Start in 90 seconds” and “File fast, get paid faster” at every key frame

- Disclaimers “Subject to policy terms” embedded as unobtrusive, tappable icons

- Human voiceovers positioned Lemonade as a helpful guide, not a corporate gatekeeper

Performance strategy: Built for mobile conversion

Lemonade didn’t just run minimalist ads. The full mobile user flow was rebuilt to support fast decision-making. Form fields were simplified, live chat prompts triggered on hesitation, and opt-in flows were embedded contextually.

Campaign results:

- CTR lift between 14–19% across paid social and display retargeting

- 28% reduction in drop-off during mobile quote completion

- Email opt-in rates increased, supporting downstream education and cross-sell efforts

By making digital ease part of the brand promise, Lemonade used simplicity as both a message and a mechanism for performance.

Digital banking & mobile ads

Mobile banking ads succeed when they engage and reassure. The best campaigns merge interactivity, personalization, and speed, while respecting strict financial compliance frameworks.

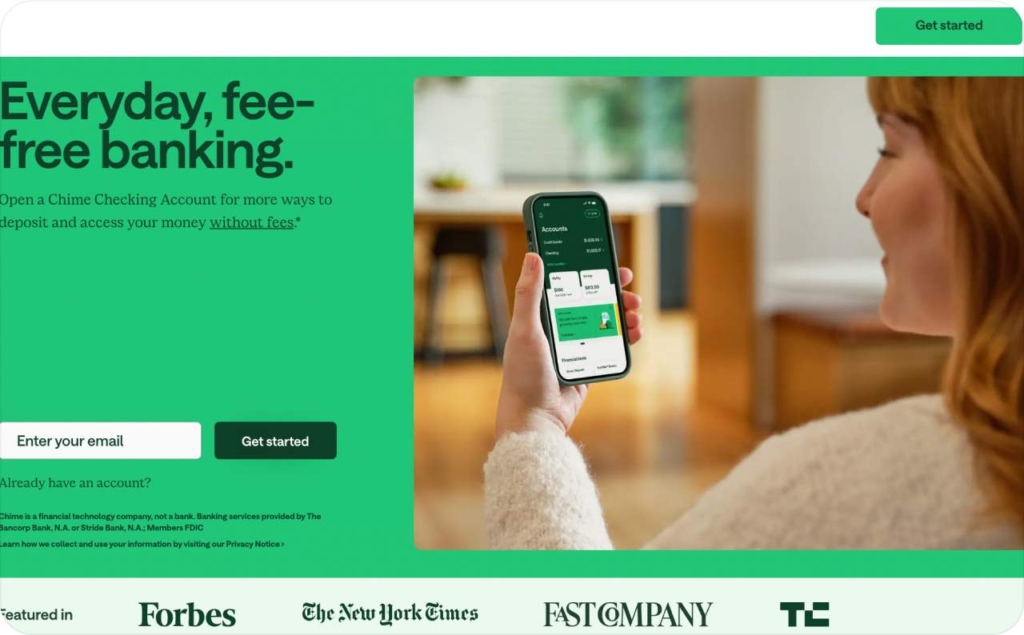

Chime — frictionless banking for a mobile-first generation

Chime’s growth strategy centers on personalized, outcome-focused onboarding designed for millennial and Gen Z users. By combining smart targeting with seamless user flows, Chime makes financial tools feel intuitive.

Campaign highlight: App-first journey with social-native creative

In 2025, Chime launched a multi-channel campaign that combined TikTok Spark Ads with Google UAC placements. Each creative asset was designed to reflect individual browsing behaviors with budgeting tools and overdraft protection prioritized for financially curious users.

The execution was multi-layered:

- In-ad product demos showed instant account setup, real-time alerts, and easy spending breakdowns

- TikTok influencers narrated real use cases: covering rent in an emergency, getting paycheck alerts early

- Every frame carried trust-building overlays: “FDIC insured,” “One-year free trial,” and “No hidden fees”

- Calls-to-action were time-bound and benefit-driven: “Get started in 2 minutes” or “Try free today”

hoto source: Chime

Digital execution: UX that reduces drop-off

Once users clicked through, Chime’s onboarding flow picked up exactly where the ad left off. Mobile screens used swipeable inputs, friendly tone, and autofill suggestions to speed things up. Key friction points, like KYC steps, were reframed as “unlocking” account features, reducing perceived effort.

Results: Personalization that drives depth

- 28% increase in app installs among users browsing budgeting or savings topics

- 35% longer average session duration within onboarding flows

- Cost per install dropped by 20% versus standard display campaigns

Rocket Mortgage — trust and speed in mobile mortgage onboarding

Rocket Mortgage continues to lead by turning traditionally slow loan processes into fast, mobile-first experiences. Their campaign focused on making the application journey feel less like paperwork and more like progress.

Campaign strategy: Security meets simplicity

The 2026 mobile campaign leaned into high-intent moments. Prospects saw interactive ads that previewed rates in real time, asked two quick eligibility questions, and fast-tracked users to a soft credit check.

Key execution features included:

- Clear CTAs like “Check your rate in 30 seconds” and “Start without documents”

- Embedded trust signals like encryption lock icons, FDIC-like compliance badges, and disclaimers “Based on credit score. Terms apply.”

- Adaptive design ensured the flow worked across devices without breakage or pixel shifts

Photo source: Rocket Mortgage

Digital execution: Optimized for conversion, not just clicks

Rocket’s mobile UX was built around progressive disclosure revealing only what was needed, when it was needed. Each screen prioritized outcomes: showing potential savings, approval odds, and personalized tips to improve results.

Results: Mobile experience, real impact

- 24% higher start rate for applications vs. desktop-first campaigns

- 18% drop in abandonment during mobile onboarding sequences

- Increased approval rate per start and attributed to lower user confusion and better upfront qualification

Car loan & financing ads

Car loan ads succeed when they turn complicated numbers into approachable, emotionally driven narratives. In a high-CPC space where confusion kills conversion, the most effective creatives build clarity, trust, and urgency. These campaigns thrive by simplifying payment structures and embedding real-time value in the visuals and language.

Ally Auto’s ad strategy transforms raw financial terms into relatable, mobile-friendly value. By focusing on clarity-first messaging and real-life use cases, Ally tackled key consumer pain points: unpredictable payments, vague interest rates, and general financing confusion.

Campaign highlight: Predictable payments, presented visually

In 2026, Ally launched a mobile-first video campaign aimed at demystifying car financing for mainstream buyers. Animated explainer videos showed what car ownership actually costs, making numbers feel accessible, not intimidating.

The execution was multi-layered:

- Video ads illustrated sample scenarios: “$0 down. $357/month. 60 months.” — layered over images of real people behind the wheel

- Real-time rate calculators embedded in carousel ads helped users estimate payments with just a swipe

- Every visual included compliance overlays: “On approved credit,” “APR may vary,” “Terms apply”

- CTAs like “See your payment breakdown” drove high-intent engagement with the pre-qualification funnel

Photo source: Ally Auto

Digital execution: Educate, don’t overwhelm

Ally’s post-click experience used interactive payment tools, amortization visuals, and simplified loan terms to guide users through each financing step. Designed for mobile, the interface kept users focused, not confused and no financial background required.

Results: Simplicity converts

- +21% lift in application form completions

- +15% higher CTR versus static, search-only display ads

- 12% lower bounce rate on video placements featuring payment breakdowns in the first 5 seconds

Capital One Auto Navigator — matching intent with precision

Capital One’s Auto Navigator campaign shows how persona-led targeting drives relevance and reduces drop-off. Rather than run one-size-fits-all creatives, Capital One built ad experiences around real buyer journeys: first-timers, upgraders, and trade-in customers.

Campaign strategy: Micro-targeting with lifestyle context

This 2026 initiative focused on reframing car financing with audience-specific language. Instead of leading with rates, the creative met users at their current car life stage, then layered in offer data to prompt action.

Key execution features included:

- Segmented carousel ad sets: “First car? We’ve got you,” “Trading in? See your new payment,” “Upgrade without surprises”

- Story-led visuals like city driving, family road trips, paired with data callouts like “Check your rate in 60 seconds”

- Compliance baked into every frame: “Pre-approval required,” “Rate based on creditworthiness,” and “Terms apply”

- Automated A/B testing refined copy tone, CTA placement, and visuals by user segment

Photo source: @capitaloneautonavigator on Instagram

Digital execution: Intent-led UX from ad to app

Once users engaged, Capital One’s landing flows continued the segmentation offering custom loan recommendations, pre-filled forms, and step-by-step guidance based on user intent. This reduced friction and increased confidence across all funnel stages.

Results: Relevance that scales

- +18% increase in conversions for first-time car buyers

- 2.1x engagement rate for persona-driven ads compared to general creatives

- 13% reduction in application abandonment when CTAs were micro-personalized

Navigating US regulatory guidelines for financial services ads

If you advertise financial products in the U.S., compliance isn’t optional, it’s strategy. Every piece of creative, from Instagram Stories to paid search ads, must follow rules set by the SEC, FTC, and FINRA. These guidelines shape not just your copy, but how you deliver value transparently and avoid costly enforcement.

What financial marketers need to know about SEC, FTC, and FINRA

The Securities and Exchange Commission governs investment-related promotions. Advertisers working with Registered Investment Advisers must follow the Investment Adviser Marketing Rule, which permits testimonials and endorsements but requires clear disclosures. Official statements that clarify enforcement posture help marketers understand gray areas without triggering violations. For instance, the SEC’s 2021 letter clarified how performance metrics can be shared on social media without misleading investors.

The Federal Trade Commission covers consumer protection across industries. If you promote credit cards, loans, or budgeting tools, you must avoid unfair or deceptive claims under the FTC Act. This includes buried disclaimers, vague benefits, or misleading “zero fee” headlines. The Truth in Lending Act adds further requirements for credit-related disclosures. Make APRs visible, not hidden in tooltips.

FINRA regulates broker-dealer marketing and focuses heavily on fair presentation. This means showing risks clearly and balancing promotional language with factual accuracy. If you use charts, performance figures, or third-party ratings, include time frames and context. FINRA also requires internal pre-approval workflows and recordkeeping for all marketing communications, a step often missed by social teams.

Compliance isn’t a barrier, it’s a competitive advantage

Navigating U.S. financial ad regulations can feel like a moving target. But marketers who embrace compliance as part of the creative process build campaigns that scale, convert, and earn trust. Whether you’re optimizing social disclosures or aligning with SEC no-action letters, staying ahead of regulation is how smart financial brands outperform the competition.

Looking to refine your next campaign with full creative-compliance alignment? Start by reviewing your disclosure strategy against SEC and FINRA guidelines.

Create powerful ads with AI

Zeely AI is transforming the way businesses advertise. Instead of spending countless hours brainstorming ideas, writing copy, and hiring expensive designers, you can now launch professional-quality ads in minutes. With over 150+ lifelike AI avatars, a wide library of customizable templates, and an advanced AI ad builder, Zeely makes it effortless to stand out online.

Whether you’re promoting financial services, clothing digital marketing, or a jewelry brand, Zeely AI gives you everything you need to create scroll-stopping ads that capture attention, build trust, and convert viewers into customers. From video campaigns to social media posts, every tool is designed to save you time while delivering real business results.

With Zeely AI, anyone can look like a pro marketer — no design or ad experience required. Just choose an avatar, select a template, let AI generate your ad, and you’re ready to publish. Start creating ads that actually work, and grow your business with the power of AI.

Also recommended